insights

2017 Year In Preview – Trends Revisited

At the end of 2016, we shared our thoughts with PharmaVOICE on potential 2017 trends. This year, PharmaVOICE asked us to comment on how those trends played out. Click here to read the full “Year in Preview” or continue reading for Halloran’s perspective on the following topics.

Combination Products

By: Greg Dombal

2017 has been a significant year for the development of the regulatory framework around combination products, in the US and Europe. In February of this past year, the European Medicines Agency (EMA) released a concept paper on their envisioned future state framework for efficient regulation of combination products. While this is just a start for EMA, it is significant in that EMA dedicated human capital and has been very present at industry gatherings. It’s critical for EMA to discuss their position and gather industry views, while preparing for a relocation of their Canary Wharf HQ as a result of Brexit.

In the US, FDA formalized a guidance regarding the classification process for combination products. This guidance substantially increases the profile of the Office of Combination Products and helps shed light on a process that has evolved significantly over the past few years. Certainly, a company needs to be clear regarding what criteria will be used to determine whether a product will be approved via drug (NDA), biologic (BLA) or device (510k or PMA) paths. This guidance is timely as new combination products have been approved in the areas of diabetes, infectious disease, immunology, urology, rheumatology, and oncology. These approvals include combinations of new products as well as new entities combined with previously approved products. In our practice, we are seeing a rapid rise in the number of clients who are seeking advice and strategic support for combination product development.

Cancer Moonshot

By: Greg Dombal

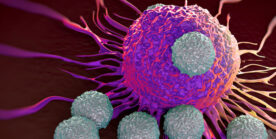

Earlier this year, we described an unprecedented level of collaboration that would be foundational and simultaneously enable activity for former VP Biden’s cancer moonshot to become a reality. Since then, there has been collaboration between researchers, physicians, pharma companies, patients, diagnostic companies, hospitals, big data providers, government, and payers in virtually every direction. This matrix of collaboration might help us disentangle the massive and complex web of DNA defects, environmental factors, and genetic mutations that always seem to outsmart each and every approach to treating cancer. We are now starting to see the fruits of those collaborations – from the first CAR-T approval to active discussion on using real-world evidence to inform drug development. Data is beginning to inform our actions, but big data, even when combined with Artificial Intelligence (AI) is not the only answer. AI is not going to uncover new breakthrough combinations of treatments because AI has to learn. Learn of the pathways that trigger cancer, the survival mechanisms of each mutated cell, and better understand the complex realities of human medical care.

There is a significant way to go and untold scientific hurdles to overcome, yet progress is being made and hope for the future springs.

Talent Wars

By: Laurie Halloran

Life science discoveries continue without any apparent abatement. The discovery and early development world has evolved in proportion to the funding that is out there, and with no surprises, the life science industry seems to be awash with opportunity. It gets more complex when laboratory work evolves into the intense human capital phases of later development.

There has been a trend throughout all industries to outsource non-core activities, but this is where the challenges lie in clinical development. As the volume of new products entering clinical development expands, there are ever greater pressures on the outsourcing providers, particular CROs. The CRO market is suffering from what amounts to a collapse of the largest tier of vendors into a few major players at the top end. At the other end, there are hundreds, if not thousands, of specialty companies that are too small to compete on most programs. As the CRO market at the top has consolidated, this enormous competition is paralleled with a decrease in overall client satisfaction. This isn’t a new phenomenon, but it gets worse each year.

The second challenge is the combination of workers in the Millennial generation who have little patience to gain experience and the dramatically increased need for experienced workers. This drives up the salaries and intensifies competition for all talent.

We’re constantly recruiting for candidates with elusive, deep experience in technical skills combined with a consulting mindset.